Tinubu's Tax Reform Bills Remain on Track Amidst National Discussion

Tinubu's Tax Reform Bills Remain the Focus of National Debate

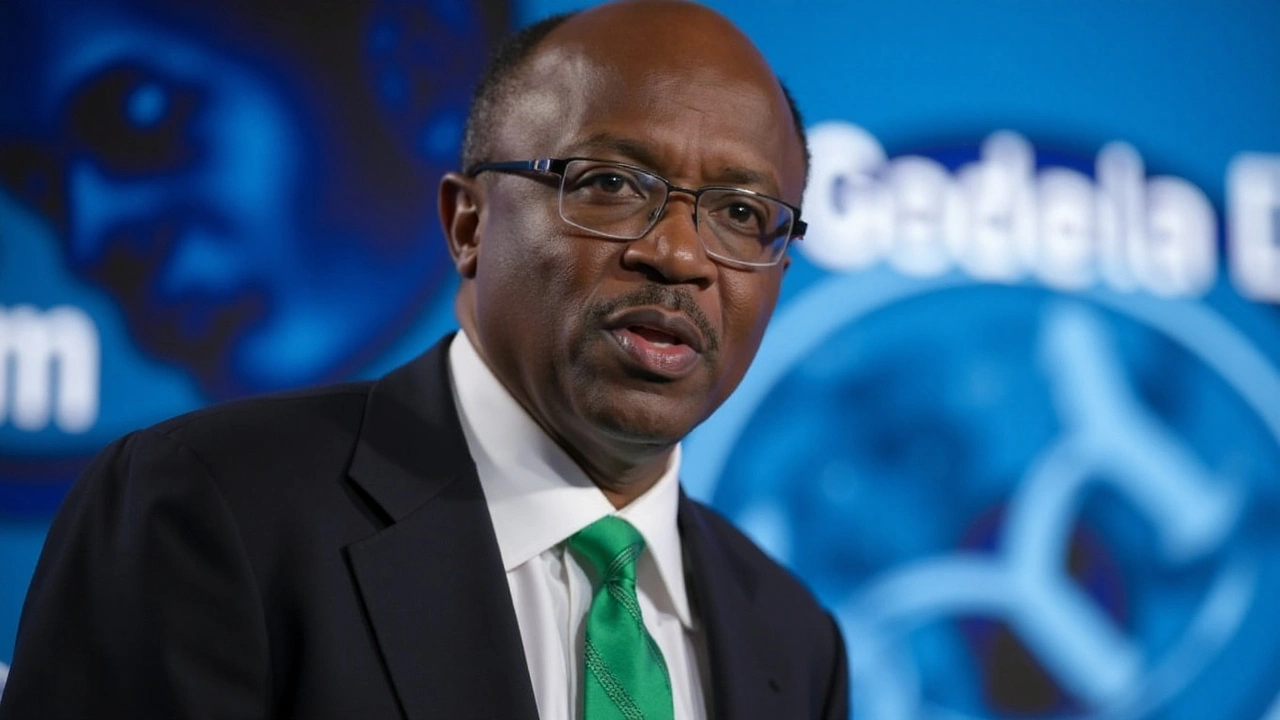

In the midst of swirling rumors and increased media scrutiny, Senate President Godswill Akpabio has firmly stated that President Bola Tinubu's proposed tax reform bills have not been withdrawn. Speaking at a Senate plenary session, Akpabio made it clear that the Senate continues its work unabated in deliberating these highly significant bills, and that any suspension or withdrawal is purely speculative at this point.

The news sent waves through the national media landscape, with many outlets previously suggesting that discussions surrounding the tax reforms had halted. Akpabio's clarification comes as a crucial reminder of the Senate's autonomy and role in legislative proceedings — a body that, he asserts, serves the interests of Nigerians above all.

Interest Representation and Legislative Procedure

"We are answerable to the people of Nigeria, and we will not bow to any external pressure," Akpabio emphasized, shedding light on the Senate's commitment to transparently represent public interest. As he further noted, the power to withdraw these reform bills resides solely with the executive branch, led by President Tinubu himself, not with the Senate. This distinction ensures a clear division of responsibilities and a well-defined process for any modifications or withdrawals.

Among the provisions embedded in these tax reform bills are significant steps aimed at alleviating financial burdens on Nigerians, such as the exemption for businesses earning less than 50 million naira annually, alongside the abolition of multiple levies which have historically impeded small business growth. These measures, Akpabio contends, are engineered to kick-start economic activity by bolstering small to medium enterprises which form the backbone of Nigeria's economy.

Extended Public Hearings and Broader Consultation

In an effort to ensure all voices are heard and concerns addressed, the Senate President has promised the possibility of extending public hearings should the initially planned six-week period for the Senate Committee on Finance prove inadequate. This extension could foster enhanced dialogue and thorough examination among the public and policymakers alike.

The decision to bolster engagement with the broader populace acknowledges the growing chorus of opinions calling for a reevaluation of the bills. Particularly critical are the voices of northern governors who have expressed concerns that the tax reforms could imperil fiscal federalism by centralizing authority, potentially reducing state-level revenues.

Executive Collaboration on Reforms

In response to these concerns, President Tinubu has instructed the Ministry of Justice to work closely with the National Assembly. This collaboration aims to refine the reforms by addressing all apprehensions raised by Nigerians clearly and comprehensively, assuring that in no way would the fiscal reforms come at the expense of impoverishing any single state or region.

Moreover, the Presidential Advisory Committee on Fiscal Policy and Tax Reform, chaired by Taiwo Oyedele, remains resolute in its quest to ensure that all stakeholders have ample opportunity to engage in meaningful consultations. Reinforcing the administration’s dialogue-driven approach, this committee stands in firm opposition to any immediate withdrawal calls, signifying a commitment to ongoing reform discussions.

A Path Forward through Dialogue and Understanding

The formation of a specialized Senate committee composed of representatives from Nigeria's six geopolitical zones further exemplifies the administration's dedication to resolving the complex issues embedded within these bills. By collaborating with the Attorney General of the Federation, this committee seeks to untangle contentious clauses and ensure that all regions’ concerns are respectfully and adequately addressed.

Stakeholder engagement remains pivotal in dissecting the nuances of the tax reform proposals. Engaging governors, religious leaders, and influential business figures through public consultations not only honors the legislative process but also promotes comprehensive scrutiny and understanding. This multi-faceted approach ensures that policy changes are transparent, inclusive, and capable of reinforcing Nigeria's economic stability.

As the nation watches closely, the Senate's endeavors to maintain deliberate dialogue and inclusive policymaking reflect a broader commitment to ensuring that these tax reforms fulfill their intended purpose of equitable economic growth. With rigorous public discourse and legislative rigor, the proposed reforms could well signal a transformative period within Nigerian fiscal policy.

Evangeline Ronson

December 7, 2024 AT 17:56Cate Shaner

December 8, 2024 AT 13:24Thomas Capriola

December 8, 2024 AT 14:56Rachael Blandin de Chalain

December 8, 2024 AT 16:10Soumya Dave

December 9, 2024 AT 07:09