Catholic Bishops Warn Finance Bill 2024 Will Deepen Kenyan Hardships

Catholic Bishops Raise Alarm Over Finance Bill 2024

The Kenya Conference of Catholic Bishops (KCCB) has issued a stark warning about the repercussions of the Finance Bill 2024. They argue that the proposed legislation, which seeks to introduce new taxes and increase existing ones, will bring about unprecedented suffering among Kenyans. Particularly affected would be the country's most vulnerable populations, including the poor and marginalized.

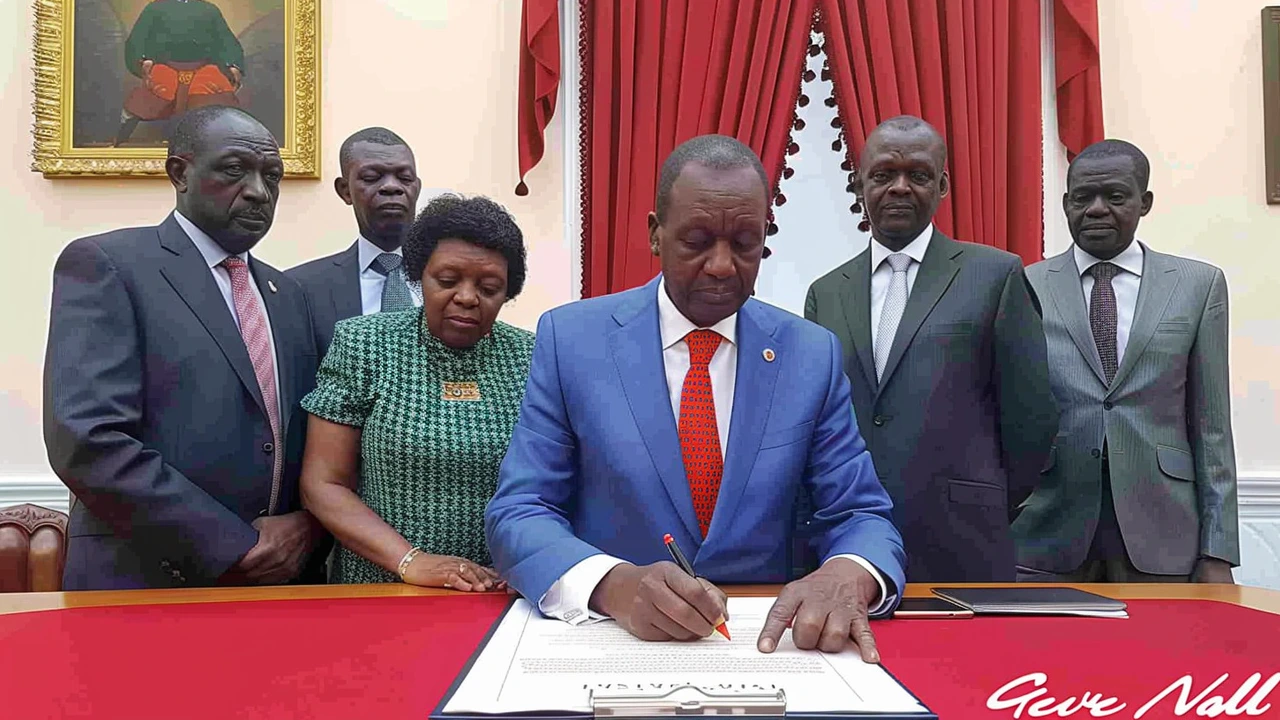

There is an impending sense of unease as the bill awaits deliberation in the National Assembly. In a statement released by the KCCB, the bishops implored President William Ruto to reconsider the financial proposals. They stressed that such measures would exacerbate the already high cost of living, plunging the majority of the population into even more dire economic conditions.

Grim Outlook for Low-Income Households

The Finance Bill 2024 is framed around the objective of raising an additional KES 100 billion in revenue. To achieve this, the bill proposes taxing essential items such as fuel, electricity, and basic commodities. These are items that virtually every Kenyan depends on, making the impending taxes particularly onerous. The KCCB's concerns are not unfounded, particularly with the proposed 15% increase in the Value Added Tax (VAT) rate. This hike would disproportionately affect low-income households already struggling to make ends meet.

The bishops have been vocal in stressing the need for a more equitable and sustainable approach to taxation. As they see it, the current proposal would place an unsustainable burden on the backs of the poor and could stifle economic growth and development.

Lack of Transparency and Consultation

In addition to their economic concerns, the KCCB has criticized the government's approach to developing this bill. The bishops argue that the entire process lacked transparency and adequate consultation with various stakeholders, which, they believe, undermines democratic principles. According to them, a more inclusive and participatory approach would yield better outcomes for all Kenyans.

The KCCB’s criticisms underline how sidelining important dialogues can lead to policies that do not reflect the public's needs. The bishops urge lawmakers to reject the bill as it stands and instead work toward creating a tax system that is inclusive and equitable. They advocate for a model that not only meets revenue goals but also fosters social and economic growth.

Economic Implications of the Finance Bill 2024

Understanding the economic implications of the Finance Bill 2024 requires an in-depth look at the proposed new taxes and the increments to existing ones. A key component of the bill is the significant hike in the VAT on essential goods and services. By raising the VAT rate to 15%, the financial burden on the average Kenyan household, particularly those in lower-income brackets, will increase substantially.

This VAT increase will directly affect the cost of living. For instance, the cost of fuel—a critical input for various sectors including transportation, manufacturing, and agriculture—will rise. Increased fuel prices typically lead to higher transportation costs, which in turn drive up the prices of goods and services. Similarly, the proposed higher taxes on electricity could translate to steeper utility bills for households and businesses. These developments would inevitably lead to a higher cost of living, affecting the purchasing power of the citizens.

Impact on Small Businesses

Small businesses, which form the backbone of Kenya's economy, could also feel the pinch. Higher operational costs may force some to downsize, lay off employees, or even close their doors. The cascading effects of such outcomes could ripple through the economy, leading to lower productivity and higher unemployment rates.

In light of these potential adversities, the bishops’ appeal for a reconsideration of the bill seems rooted in a desire to safeguard the welfare of Kenyans. They advocate for a taxation model that encourages economic growth and stimulates development, rather than one that primarily focuses on revenue generation.

The Bishops’ Vision for Equitable Taxation

At the heart of the KCCB’s opposition is a vision for a more just and sustainable tax system. They argue for fiscal measures that do not disproportionately burden the poor. Instead, they envision a framework that balances revenue generation with the need to stimulate economic activity and nurture growth.

One of the proposals from the bishops is to increase taxes on luxury goods and services, which would primarily affect the wealthy. This, they believe, would be a more equitable way of generating the necessary revenue without putting undue pressure on those least able to afford it. They also suggest introducing more tiered tax rates based on income levels, ensuring that higher earners contribute a fairer share.

Encouraging Economic Growth

In addition, the KCCB emphasizes the importance of policies that support small and medium-sized enterprises (SMEs). By providing tax incentives and reducing bureaucratic barriers, the government could foster an environment where SMEs can thrive. This, in turn, would create jobs, increase productivity, and contribute to economic growth.

The bishops also call for greater investment in social services, such as healthcare and education. These are essential components of a thriving society and provide the foundation for long-term economic stability. When people are healthy and well-educated, they are better able to contribute to the economy, creating a cycle of growth and development.

A Call for Greater Consultation and Transparency

The lack of consultation and transparency in the development of the Finance Bill 2024 is another critical issue highlighted by the KCCB. The bishops argue that involving more stakeholders in the process would not only lead to more balanced and fair policies but also strengthen the democratic fabric of the nation.

By conducting thorough consultations with various sectors of society, including civil society organizations, business representatives, and ordinary citizens, the government can better understand the real-world implications of its policies. This participatory approach would likely result in a tax system that is more attuned to the needs and realities of all Kenyans.

Strengthening Democratic Principles

The bishops believe that strengthening democratic principles via transparency and consultation can lead to more effective and accepted policies. They call for the establishment of forums and platforms where citizens can voice their concerns and contribute to the policy-making process. This would not only improve the quality of the policies themselves but also increase public trust and support for the government.

In sum, the KCCB's urgent call for revision of the Finance Bill 2024 highlights the need for a balanced approach to taxation. One that ensures economic growth and development while safeguarding the welfare of the nation's most vulnerable citizens. Their vision of an equitable and transparent tax system is a reminder that fiscal policies should serve the people and nurture a fair and prosperous society.

Alex Braha Stoll

June 14, 2024 AT 06:04Meanwhile, the rich are still getting tax breaks on yachts and private jets. This isn't fiscal policy. It's class warfare dressed up as math.

Vitthal Sharma

June 14, 2024 AT 13:38anand verma

June 14, 2024 AT 23:53Sagar Solanki

June 15, 2024 AT 21:38Monika Chrząstek

June 16, 2024 AT 01:37Thomas Mathew

June 16, 2024 AT 03:22Why are we even talking about taxes? The system is rigged. The state is a corporation. The people are customers. The bishops want a fairer customer experience. But the machine doesn’t care. It eats hope and spits out debt. We need to burn the ledger. Not rewrite it. 🕊️🔥

What if we just stopped paying? Not violently. Spiritually. With silence. With refusal. With collective non-compliance. That’s the real revolution. Not petitions. Not bishops. Not bills. Just… no.

chandra aja

June 16, 2024 AT 05:20Nathan Roberson

June 16, 2024 AT 22:39Monika Chrząstek

June 16, 2024 AT 23:57